AI in Finance – benefits, use cases and trends

Introduction

Artificial Intelligence (AI) is transforming finance industry by helping companies work faster, serve customers better, and make smarter decisions. With AI, banks, investment firms, and other financial institutions are gaining new tools to handle challenges like fraud, complex data analysis, and personalized customer experiences. In this article, we’ll explore the key benefits of AI in finance, look at real-world examples, and talk about the latest trends.

Challenges in Finance and How AI helps to solve them

Before we dive in, let’s take a look at some challenges financial firms face in their day-to-day operations and how AI helps to solve them:

Slow, Manual Work

Slow, Manual Work

Financial companies often need people to do repetitive, time-consuming tasks like typing in data, reviewing documents, or checking transactions. This takes a lot of time, costs money, and can lead to mistakes because humans can get tired or miss small details.

AI can take over these repetitive tasks and complete it much faster and more accurately. This saves companies time, reduces mistakes, and allows employees to work on more strategic tasks.

Difficulty Catching Fraud Quickly

Difficulty Catching Fraud Quickly

Spotting fraudulent activities, like suspicious purchases or unauthorized transactions, can be very challenging and often happens too late. Without fast detection, a company may lose money and customers may lose trust.

AI can watch over transactions in real-time, looking for unusual patterns that suggest fraud. It flags suspicious activities instantly, and helps companies stop fraud before it causes big problems. This keeps accounts safe and builds customer trust.

Limited Personalization for Customers

Limited Personalization for Customers

Financial companies may give all customers the same general products and advice, which doesn’t work for everyone. Each customer has unique needs, but it’s hard to personalize services without help from technology.

AI can analyze each customer’s behaviour and preferences, offering customized recommendations or products that fit their specific needs. This makes customers feel understood and more likely to stay loyal to the company.

Slow and Risky Decision-Making

Slow and Risky Decision-Making

To decide if a loan, investment, or other financial decision is safe, companies have to analyze a lot of data, which takes time. Without AI, they might miss important details, and take risky decisions.

AI quickly goes through large amounts of data to assess risks more accurately. This helps companies make safer choices in areas like lending or investing, which protects both the company and its clients.

Hard-to-Track Compliance with Rules

Hard-to-Track Compliance with Rules

Financial firms have to follow strict rules to ensure fair and legal practices. Tracking these rules requires a lot of time and effort. Small mistakes can lead to fines or legal issues.

AI automatically monitors transactions and activities. It can spot potential compliance issues right away, and help companies avoid penalties and stay in good standing with regulators.

Inaccurate Market Predictions

Inaccurate Market Predictions

Traditional methods for predicting market trends might not take into account complex factors, it can be less reliable. This can lead to poor investment strategies and lost opportunities.

AI processes massive amounts of data in real time, spot patterns and trends that might go unnoticed. This allows companies to make better predictions about the market, and helps to make smarter investment decisions and brings better financial outcomes.

Long Wait Times for Customer Service

Long Wait Times for Customer Service

Customer service teams often get overloaded with questions and requests, that can increase wait times. Customers may feel frustrated if they have to wait too long for help.

AI chatbots and virtual assistants can handle many customer inquiries instantly. They can answer common questions or guide customers through basic processes, saves human agents time so they can help with more complex issues. This results into faster responses and happier customers.

Statistics

According to a Gartner survey, 58% of finance functions used AI in 2024, a 21 percentage point increase from 2023.

Key Benefits of AI in Finance

AI brings some powerful benefits to finance:

Real-World Examples

Many businesses are already using AI in various ways:

These examples show AI helps in making finance processes faster, more reliable, and better suited to each person’s needs, while also helping businesses operate in a more secure way.

AI Trends in Finance

AI is constantly improving and it brings new trends that help banks, investment firms, and other financial institutions serve customers better. Here are some of the key trends:

AI-based Chatbots and Virtual Assistants

AI-based Chatbots and Virtual Assistants

Majority of banks and financial companies are using AI chatbots to answer customer questions quickly. These chatbots can do more than answer basic questions; they can help customers with transactions, manage their accounts, or even give personalized financial advice. It makes customer service faster, and since these AI tools are always available, customers don’t have to wait for support.

Robo-Advisors for Investing

Robo-Advisors for Investing

Robo-advisors are AI tools that help people manage investments. They analyze a user’s financial goals and risk tolerance and create a personalized investment portfolio. They also adjust it over time to keep it in line with the person’s goals, and helps to make investment accessible and affordable even for beginners who don’t have a financial advisor.

Predictive Analytics for Better Decision-Making

Predictive Analytics for Better Decision-Making

AI can predict future trends by analyzing past data. For example, it can look at past stock prices to help investors decide when to buy or sell or predict loan default risks to help banks lend more responsibly. Predictive analytics helps financial professionals make smarter choices based on data rather than guesses.

Fraud Detection and Prevention

Fraud Detection and Prevention

AI systems are focused on catching fraud in real time. By studying patterns, AI can detect suspicious transactions – like an unusual purchase or money transfer. Banks and payment companies rely on this technology to catch and stop fraud before it affects customers, and makes financial transactions safer.

AI-based Personalization

AI-based Personalization

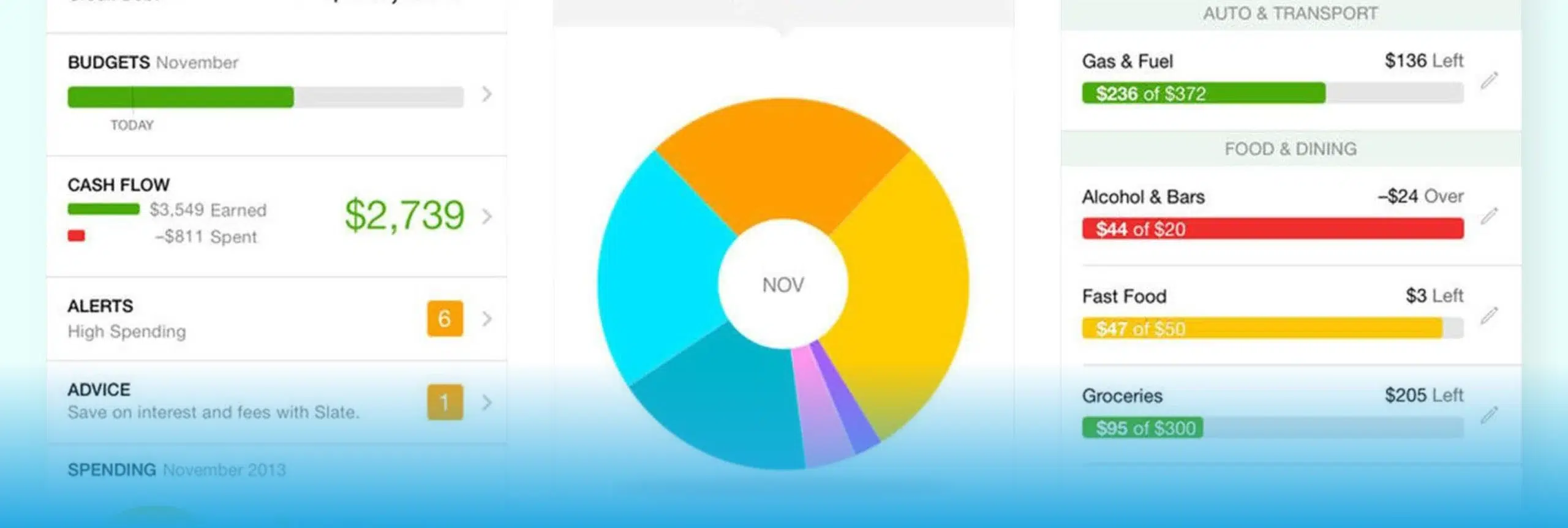

Financial companies are using AI to personalize services based on each customer’s habits and preferences. For example, some banks analyze your spending to offer budgeting tips or recommend credit cards that fit your lifestyle. This personalization makes banking feel more relevant to individual customers and improves their experience.

Natural Language Processing (NLP) for Analyzing Text

Natural Language Processing (NLP) for Analyzing Text

NLP is a branch of AI that helps computers understand human language. Financial firms use NLP to analyze text from news articles, social media, and reports to analyze public sentiment and market trends. This can help them react quickly to changes in the market, like sudden interest in a particular stock or product.

Algorithmic Trading and High-Frequency Trading (HFT)

Algorithmic Trading and High-Frequency Trading (HFT)

Algorithmic trading uses AI algorithms to execute trades automatically at high speeds. This is popular among investment firms because it lets them make trades based on small price changes in real time. High-frequency trading is a type of algorithmic trading that executes thousands of trades in milliseconds, aiming to profit from quick price shifts.

Credit Scoring and Lending Decisions

Credit Scoring and Lending Decisions

Banks and lenders are using AI to make lending decisions based on a wider range of data, not just credit scores. AI can consider things like employment history, spending habits, and even education. This approach makes lending more accessible, especially for people with limited credit history, as it provides a more complete view of their ability to repay.

Risk Management and Regulatory Compliance

Risk Management and Regulatory Compliance

Financial institutions face a lot of regulations. AI helps them follow these rules by analyzing transactions and identifying anything that doesn’t comply. AI can also help predict risks by analyzing trends, and helps companies to prepare for market fluctuations or economic downturns. This keeps financial firms safer and more stable.

These AI trends are transforming finance by making it more personalized and secure. The result is a better experience for customers and more efficient operations for financial firms.

Future Possibilities with AI in Finance

The future of AI in finance is exciting, with possibilities that could change how we manage money, invest, and protect our finances. Here are some of the most promising ways AI might shape the future of finance:

Fully Automated Customer Service

Fully Automated Customer Service

We could see AI-based customer service that’s so advanced, it feels almost human. Future AI systems will be able to understand emotions and respond to complex questions in natural language, offering quick and personalized help 24/7. This would give people instant assistance with almost any financial question or issue without waiting in line.

Smarter, Real-Time Investment Advice

Smarter, Real-Time Investment Advice

AI could provide investment advice based on each person’s financial goals and risk tolerance in real-time. Imagine having a virtual financial advisor that learns from markets as they happen and suggests the best moves for your money in the moment, whether it’s buying stocks, bonds, or even digital assets like cryptocurrency.

Advanced Fraud Prevention

Advanced Fraud Prevention

As scams get more complex, AI will become even better at detecting them. Future AI systems might analyze patterns across all your accounts and alert you instantly if they detect any risk. They could even block suspicious transactions automatically, and help to protect people’s money more effectively.

Personalized Financial Products

Personalized Financial Products

AI could create personalized banking products for each customer, like custom credit cards or loans with terms based on their unique needs and financial history. For example, if you often travel, your bank might offer you a card with travel rewards that you didn’t even know you’d love. This would make financial products more relevant and useful for each individual.

Automated Regulatory Compliance

Automated Regulatory Compliance

Banks and financial institutions must follow strict regulations. AI could soon automate compliance checks by scanning transactions and flagging anything unusual in real-time. This would help banks stay within legal guidelines without so much manual work and reduce the chances of human error.

Real-Time Risk Management

Real-Time Risk Management

With future AI systems, financial institutions could respond to risks (like a sudden market drop or economic news) instantly, rather than after a delay. AI could analyze new information quickly and adjust financial strategies or investments on the spot, and will make it easier for companies and investors to protect their finances.

Financial Coaching for Everyone

Financial Coaching for Everyone

AI could become a personal financial coach, and help people with day-to-day financial decisions. For example, it might suggest where to save money, help you pay down debt faster, or create a spending plan. Imagine an AI assistant that knows your financial habits and helps you make smarter money choices without any judgment.

Blockchain and Smart Contracts Integration

Blockchain and Smart Contracts Integration

In the future, AI might work with blockchain technology to create “smart contracts,” which are digital agreements that automatically enforce terms once conditions are met. This could make loans, insurance claims, or even business contracts faster, cheaper, and safer by reducing the need for intermediaries like brokers or lawyers.

Global Financial Access

Global Financial Access

AI could help make financial services accessible to people who don’t have traditional bank accounts or live in remote areas. By using mobile technology and AI-based platforms, these people could access basic financial services, receive loans, and even participate in global markets. This would help reduce poverty and support economic growth worldwide.

Predictive Financial Planning for Businesses

Predictive Financial Planning for Businesses

For businesses, future AI tools could predict cash flow, expenses, and revenue with great accuracy. Companies could use these forecasts to plan their budgets and manage resources better, helping them to grow and operate with less financial uncertainty.

Conclusion

AI is here to bring major improvements to the finance industry by making processes. It is helping banks, investors and people to manage money smarter and more safely. With tools that detect fraud, automate customer service, and personalize financial advice, AI is making financial services faster and easier to use. As AI technology continues to grow, it will create even more ways to provide better support and opportunities for everyone.

Related Post

-

F

-

A

-

Q

AI in finance means using smart computer programs to help banks, investment firms, and other financial companies work more easily. AI can help with things like detecting fraud, predicting market trends, and providing personalized advice.

AI-based tools like chatbots and virtual assistants offer customers 24/7 support, quick answers to their questions, and even personalized advice. This means better service with reduced wait times for customers.

AI can automate repetitive tasks, like data entry, transaction processing, and reporting, reduces the need for manual work. This not only saves time but also lowers operational costs, helping firms to invest more in growth and customer services.

AI can analyze large amounts of data to detect patterns and potential risks, like predicting market downturns or identifying customers who may default on loans. This helps financial firms make safer decisions and better manage their financial risk.

AI helps financial firms to understand each customer's preferences and behaviours for targeted marketing. This personalization means clients get relevant offers and advice, making them more likely to engage with the firm's products.

AI can automate repetitive tasks like document processing, data entry, and compliance checks. This reduces errors, speeds up operations, and frees up staff to focus on more strategic tasks.

AI improves customer satisfaction and loyalty by offering faster, more personalized, and secure services. Clients feel valued when they receive tailored solutions and more responsive service, which helps firms build strong and long-term relationships.

Want to Scale

Your Business? Let’s Meet & Discuss!

CANADA

30 Eglinton Ave W Mississauga, Ontario L5R 3E7

INDIA

3rd floor Purusharth Plaza, Amin Marg, Rajkot, Gujarat. 360002

Get a Quote Now

Let's delve into a thorough understanding of your challenges and explore potential solutions together

Slow, Manual Work

Slow, Manual Work